Documents Required for SME and Startup Loans

Securing a loan is often a key milestone for SMEs and startups, whether it’s for working capital, expansion, equipment purchase, or stabilising cash flow. Yet one of the biggest reasons loan applications get delayed or rejected is not financial performance, but incomplete or inconsistent documentation. Lenders rely heavily on documents to verify identity, assess creditworthiness, and ensure regulatory compliance.

When documents are disorganised or unclear, the underwriting process slows down, and the chances of approval drop. On the other hand, clean, well-structured documentation can significantly increase approval speed and even improve loan terms.

To help founders prepare with confidence, here’s a comprehensive breakdown of the documents required for SME and startup loans in 2025–26.

Overview

- Lenders require documents to verify your identity, business legitimacy, financial health, and compliance readiness.

- Key SME loan documents include KYC, GST filings, ITRs, bank statements, financial statements, invoices, contracts, and business registration details.

- Banks require the most documentation, NBFCs moderate documentation, and fintech lenders the least.

- Clean, consistent documentation improves the chances of loan approval and lowers risk perception.

Why Documentation Matters in SME Loan Applications?

Documentation forms the backbone of a lender’s decision-making process. Even when a business is financially stable, missing or inconsistent documents raise doubts and weaken the application.

Lenders rely on documents to:

- Verify business legitimacy

- Evaluate financial stability and risk

- Check regulatory compliance

- Confirm promoter identity and creditworthiness

- Prevent fraud and misreporting

Strong documentation isn’t just about meeting requirements; it signals discipline, reliability, and transparency. This is why understanding what lenders need and why they need it is crucial before applying.

With this context, let’s break down the mandatory SME loan documents for 2025–26.

Also read: Decoding the Loan Components in Working Capital Finance

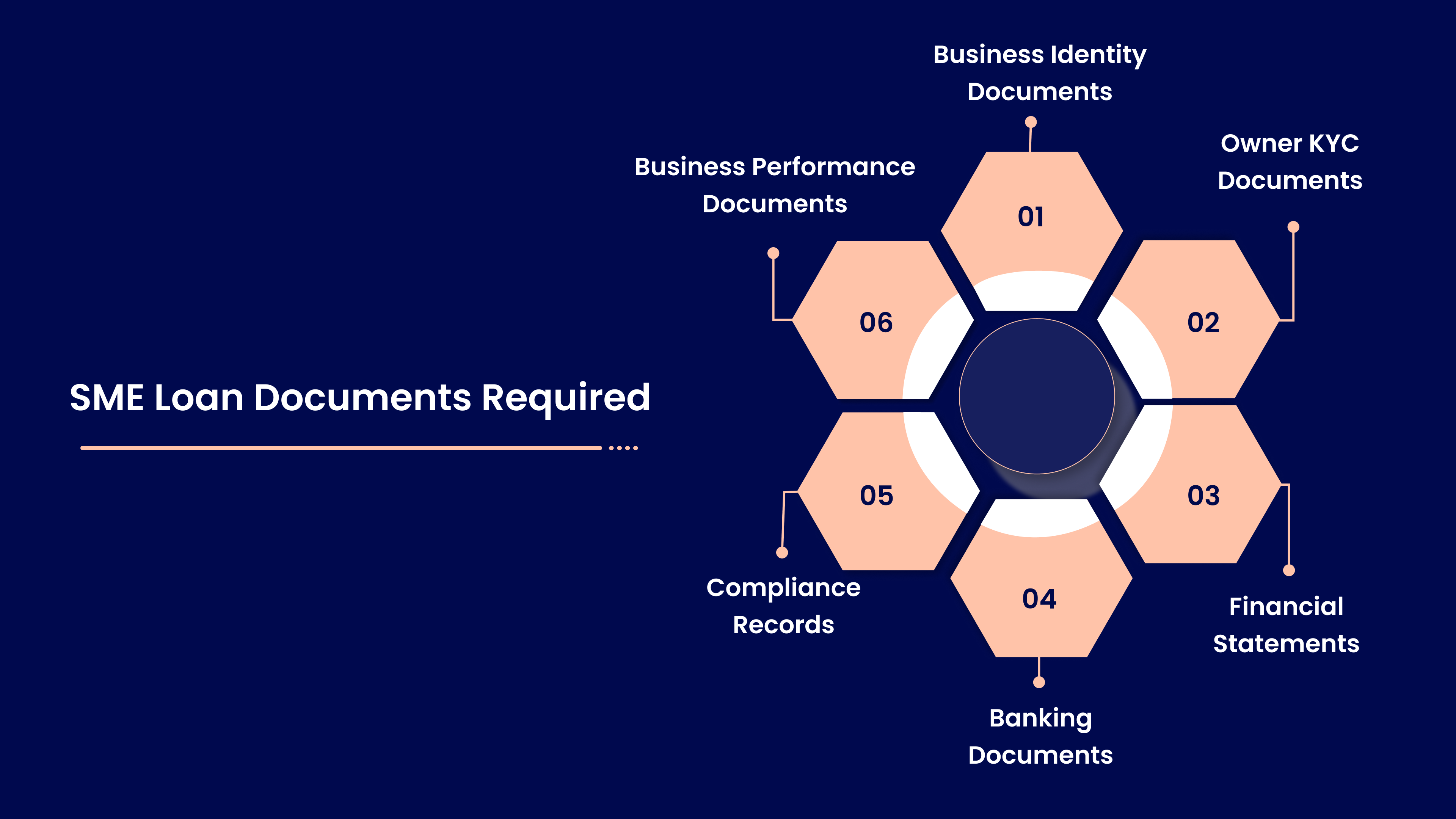

SME Loan Documents Required in 2025-26

Document requirements are broadly grouped into six categories. Each serves a different purpose in the loan approval process.

1. Business Identity Documents

These prove the legal existence and structure of your business.

Common documents include:

- Certificate of Incorporation / Partnership Deed / Shop & Establishment License

- GST Registration (GSTIN)

- Udyam Registration Certificate

- Business PAN

These documents help lenders validate your business identity, ownership structure, and operating legitimacy.

2. Promoter / Owner KYC Documents

Most lenders require both business and personal KYC.

Typical promoter KYC includes:

- Aadhaar card

- PAN card

- Passport / Driving license / Voter ID

- Address proof

Even incorporated businesses must submit promoter KYC, as lenders evaluate the individuals behind the company.

3. Financial Statements

Financial statements indicate how well the business is performing.

Lenders typically request:

- Audited or provisional Profit & Loss statement

- Balance sheet

- Cash flow statements

These help lenders understand profitability, leverage, cash movement, and financial discipline.

4. Banking Documents

Bank statements offer real-time evidence of cash flow behavior.

Lenders usually require:

- 6–12 months of bank statements

- Evidence of consistent credit and debit patterns

- Limited cheque bounces

- Healthy average monthly balance

Since bank statements reflect daily operations, lenders cross-check them with GST and financial statements to confirm accuracy.

5. Tax and Compliance Records

Tax compliance is an essential indicator of business credibility.

Documents required include:

- GST returns (typically 12–24 months)

- Income Tax Returns (business + promoter)

- Udyam registration

Consistent filings help lenders trust reported revenue and financial activity.

6. Business Performance Documents

These provide clarity on operational strength. These may include:

- Sales invoices

- Purchase orders

- Work orders

- Vendor or customer contracts

- Invoice ageing reports

Such documents help lenders understand revenue reliability, customer relationships, and operational cycles.

Now that we’ve covered what documents are needed, let’s explore how lenders interpret them.

Also read: Understanding Venture Capital Finance for SMEs in India: A Comprehensive Guide

What Lenders Evaluate in Each Document?

Each document tells lenders something specific about your business. Together, they create a complete picture of risk and capability.

Here’s what lenders assess:

- KYC: Identity, authenticity, and promoter credibility

- Financial statements: Profitability trends, debt levels, capital efficiency

- Bank statements: Cash flow stability, working capital gaps, payment cycles

- GST filings: Turnover accuracy, compliance habits, seasonal trends

- ITR: Income declaration and tax discipline

- Invoices & contracts: Business pipeline predictability

To avoid inconsistencies, SMEs must ensure all documents reflect the same revenue patterns. AICA helps businesses maintain synchronised financial data across bank statements, GST, and accounting tools, reducing discrepancies that often slow approvals.

With this evaluation framework in mind, it’s helpful to compare documentation requirements across lender types.

Documentation Requirements: Banks vs NBFCs vs Fintech Lenders

Each type of lender has different documentation expectations based on its underwriting models.

Understanding these differences helps SMEs prepare the appropriate documentation for the lender they target.

To strengthen your application further, you'll need to prepare carefully.

How SMEs Can Prepare Documentation for Faster Loan Approval?

Loan readiness improves significantly when businesses stay documentation-ready throughout the year. Key steps include:

- Update financial statements quarterly

- Maintain a separate business bank account

- File GST and ITR on time

- Digitise and organise essential documents

- Ensure revenue numbers match across all filings

- Use AICA to monitor financials in real time

- Keep scanned copies of key KYC and business records

Well-prepared documentation reduces approval time from weeks to days.

Even with digital advancements, many SMEs still struggle with documentation. This is where Recur Club becomes a valuable alternative.

Also read: Business Term Loan vs Line of Credit Which Financing Option Suits Your SME Best

How Recur Club Supports SMEs Facing Documentation Challenges

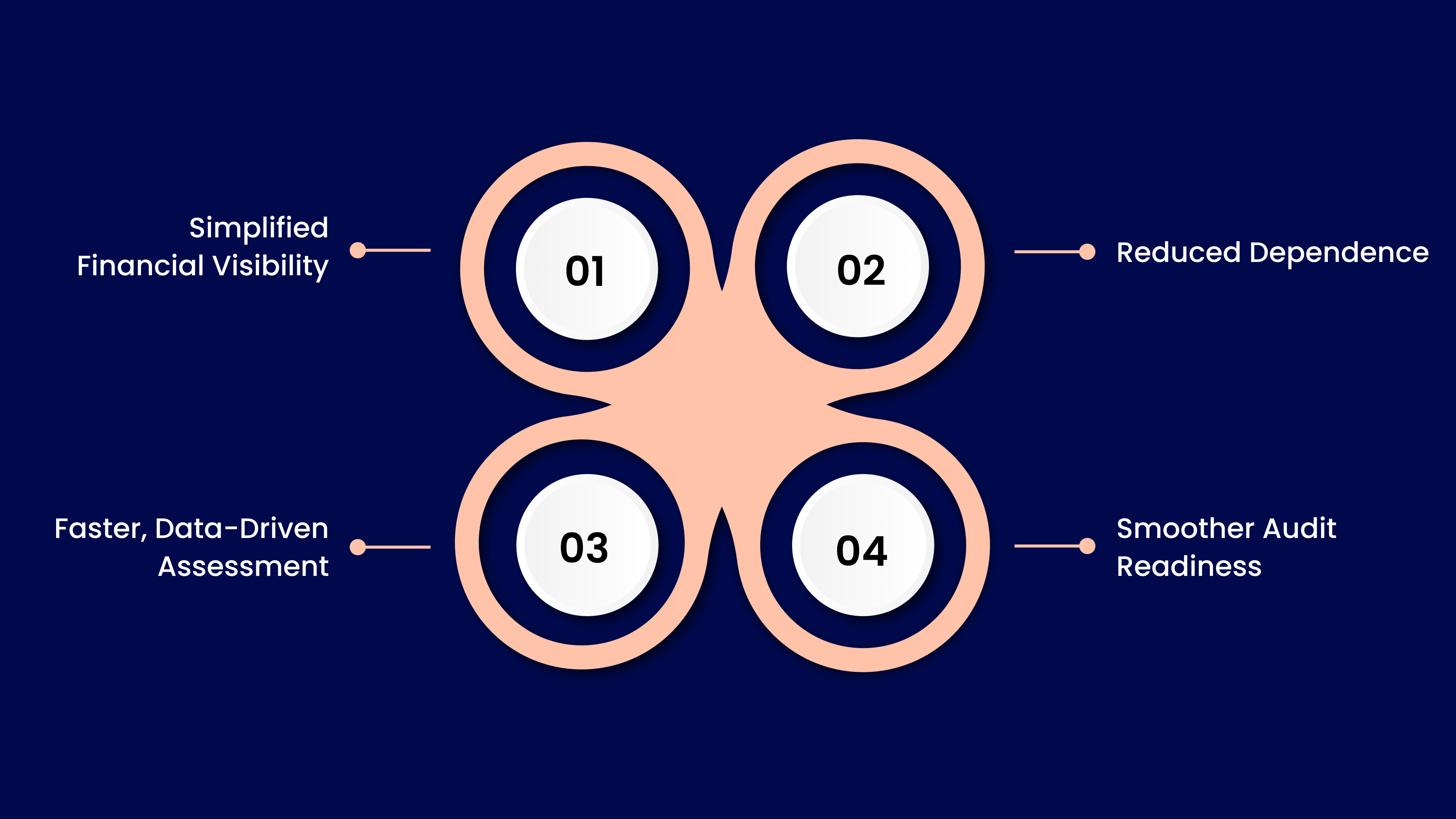

Recur Club and its AI engine AICA helps SMEs and startups organise, validate, and present their loan documents in a structured, lender-friendly way.

- One place for all documents: Recur Club helps founders bring together bank statements, GST data, financials, and compliance records instead of managing scattered files.

- Clarity on what lenders need: Instead of guessing or over-submitting, businesses get a clear view of which documents matter and when they’re required.

- Less back-and-forth: AICA automatically organises uploaded documents and flags missing or inconsistent data that often cause delays.

- Fewer mismatches in numbers: The AI checks alignment across GST, bank statements, and tax records, a common reason for lender pushback.

- Built for lean teams: Especially useful for SMEs and startups without dedicated finance teams, reducing time spent chasing paperwork.

- Beyond documentation, Recur Club connects businesses to 100+ lenders across banks, NBFCs, and alternative credit providers, helping 2,000+ SMEs and startups access ₹3,000+ crore in debt based on clean, well-presented financial data.

Together, Recur Club and AICA make loan documentation simpler, cleaner, and easier for lenders to review, helping applications move forward smoothly.

Conclusion

Clear, complete documentation isn’t just a checklist, it shapes how lenders understand your business, assess risk, and make funding decisions. Well-organised financials, compliance records, and performance data help you avoid unnecessary delays and increase your chances of timely approval.

Platforms like Recur Club use technology and expert guidance to help businesses present their financial and compliance data in a lender-ready format, while AICA automates the collection and organisation of your financial documents so nothing critical gets missed. Both can make your loan submission more coherent and easier for lenders to evaluate quickly. Start streamlining your documentation process today to improve your loan approval results.

Frequently Asked Questions

1. Can SMEs get loans without audited financials?

In many cases, yes. NBFCs and fintech lenders may accept provisional statements if other documents are strong.

2. Are digital copies of documents accepted?

Most lenders now accept scanned or digital copies during preliminary evaluation.

3. How many years of GST or ITR records are required?

Typically 1–2 years, depending on the lender and loan size.

4. What if personal and business banking are mixed?

This complicates underwriting. Lenders prefer separated banking for clarity.

5. Do lenders verify invoices manually?

Some do, but most fintech lenders now use automated invoice verification tools.

.png)

.jpg)